EDUCATION

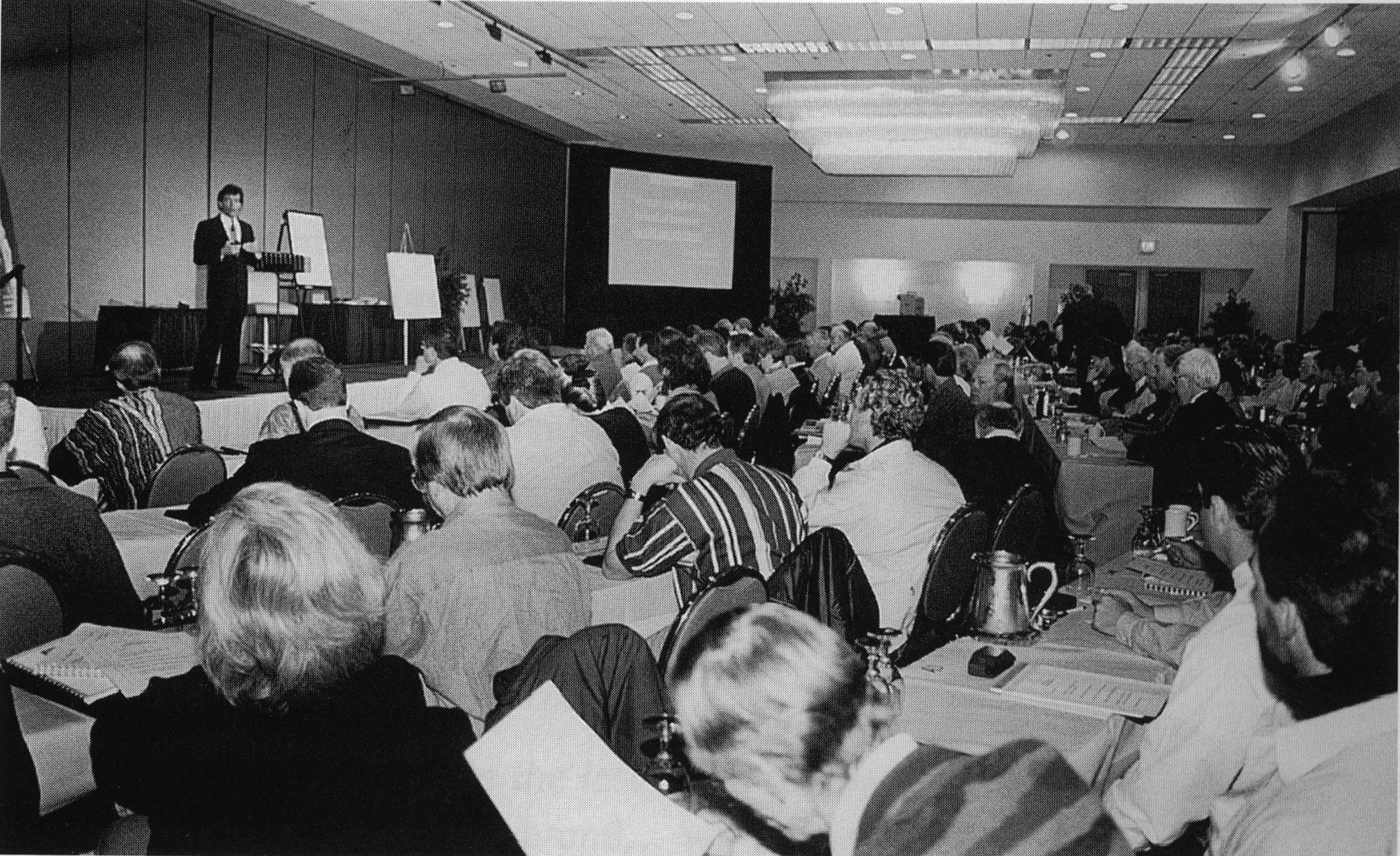

Mark Presenting his Capital Raising Course in Taipei, Taiwan

“Thank you for a tremendous ‘how to’ course. The sophisticated topics were taught and documented in an easy to understand, step-by-step way.”

Ed Griffin Senior Vice President, Koll Company

Rick Newton Past Director Denver Venture Group

IS THIS CONTENT RIGHT FOR YOU

IT IS RIGHT FOR YOU IF…

- You are a full or part time syndicator and have some experience developing or acquiring projects and raising capital.

- Your current project or corporate profile is not institutional grade yet (size, type, financial strength, track record).

- You are motivated now to raise $10-50 million per year of equity.

- You are trying to build a long term presence for your company.

- Your budget, time and resources are already stretched.

OUR CONTENT WILL SHOW YOU HOW:

- To eliminate costly false starts, guesswork and strategies that don’t produce results.

- To position your company’s story among competitors and win a permanent place on your new investors’ shelves for their repeat investments with you.

- To secure permanent and gap financing easier.

- To secure better deals and longer escrows.

- To secure that all-important track record without raising new capital.

- To transition your operations to use our system without reinventing your whole company.

- To use our systems so they pay for themselves while your bigger deals fees and profit participations go straight to your bottom line.

- To create a new value component to increase the overall worth of your company’s own stock.

- To overcome “bad times”, “bad track record” or other overwhelming negative factors and keep your capital raising on schedule.

- To use project and corporate economic and strategic models others have used – so you don’t have to reinvent the wheel.

HISTORY- 16,000 Attendees In 5 Countries

We began our quest to deliver first class syndication education in 1978. Then the real estate syndication industry was in its infancy. The federal and state securities regulators, as well as the IRS, were, for the first time, confronting an industry in the making. The National Association of Realtors for the first time set up a division for real estate syndication known as the Real Estate Securities and Syndication Institute (RESSI). RESSI offered education and certifications. We offered our education platform at the same time and one might say correctly “we were competing against RESSI.” It was never clear whether we or RESSI taught more real estate entrepreneurs and executives. This photograph of our curriculum’s course books, shown on the banner above, and textbooks represents almost 100 hours of classroom content. Our courses are customized to fit the “experience curve” of real estate syndicators. Beginners, part-timers, advanced and full-timers all have a course or two or three right for their experience.

Best in Class Sponsors Over 16,000 entrepreneurs and executives have studied with us at our seminars, courses and trainings, in 5 countries. Over 100 universities, broker-dealers, investment bankers, venture capital, law and accounting firms have paid to be sponsors at our seminars.

Syndication “Principles” Never Change. “Practices” Can Change. We know, from over 40 years of direct experience, as lawyers, syndicators, and educators through many good and bad business cycles, that syndication success is dependent on timing, knowledge, creativity, and wisdom. Using an analogy – if the syndication process was a computer, then timing, knowledge, creativity, and wisdom would be its operating system.

90% Right = 0% Success Law Real estate syndication is a complex business process. Like any complex process being 90% right most often results in 0% success. You get it “all right” or risk being “all wrong”. Rarely does “being close” win.

90% Of Outcome Is In The First 10% Of The Process- why education is critical “Process engineers and consultants have long recognized the universal principle that 90% of the outcome of any project/process occurs during the first 10% of that project/process.” – W. Edward Deming Creator of the Total Quality Management Field

TRAINING/SEMINARS

Currently our training events are customized on a sponsor/client as-needed basis. Soon many of our courses’ critical subject areas will be produced into on-line videos. Much of our educational content is timeless. Principles never change. Due to demand we have decided to sell several course manuals and several special-topic training material.

BOOKS

Jim Wendling Vice President Rancon Development Corporation

FINANCING THE NEW VENTURE

365 Pages Includes the 110 tactics and tools used for investor solicitation. #1 financing book on Amazon in 2000

“Extraordinary, phenomenal, most comprehensive explanation of what it takes to raise equity capital I have ever seen.” -Bruce Blechman, Author Guerrilla Financing

Dr. James Callicoat President, Premium Securities

BIG MONEY BROKERAGE: THE LAW AND METHODS OF REAL ESTATE GROUP INVESTING – VOL. 1

430 Pages. Published in 1981.

“Mark Long is the Tom Peters of Real Estate Syndication… every senior officer and marketer in real estate syndication will benefit tangibly and immeasurably from reading anything Mark writes.”

– Robert Stanger Chairman of the Board, Robert A. Stanger & Co. Publisher “Stanger Report”. Syndication Industry’s Number 1 Research Analyst

“The text is a rare combination of high level professional content and clear down-to-earth writing that can be understood by the professional and non-professional alike. I welcome its arrival and comment Mr. Long for his contribution to the industry.”

Marvin B. Starr Miller, Starr, and Regalia

Big Money Brokerage: Partnership Exchanges And Sponsor Tax Techniques

335 Pages. Published in 1981.

CASE STUDIES (available for free download)

“Mark’s courses have to be an annual event for Austin…. My firm previews 50 executive training programs a year. Mark’s courses rate at the very top”

Dr. August Smith Publisher: Executive Reviews

“Mark Long provides a personalized,

provocative, ‘sermon’ with insights that can stimulate new ideas for those in real estate securities business.”

Stephen Roulac

President Roulac & Company

Publisher, “Roulac’s Strategic Real Estate”